What Is Risk Management?

The risks of trading Forex include:

- Country risk (e.g., ratings downgrade)

- Sovereign risk (e.g., asset-freezing, expropriation)

- Liquidity risk (no buyers if you are a seller)

- Credit risk (counterparty or broker fails)

- Price risk (price moves against you fast and without warning)

You should be trading a currency that does not have a lot of country or sovereign risk — i.e., the majors. If you choose to trade an emerging market or frontier currency, you will have country and sovereign risk — as well as liquidity risk — and once a crisis has appeared, you have almost no remedies against a crashing price. As for credit risk, you can control credit risk to a large extent by keeping your brokerage account at a broker that has adequate capital, no grievances registered at regulators for fraud or failure to perform, and probably most of all, no complaints by credible chat-room writers and bloggers.

Price Risk

As a day-to-day practical matter, the risk you can actually manage is price risk. The high-end risk management industry speaks in exalted terms about identifying and mitigating risk, but for the purpose of becoming a successful Forex trader, this boils down to some statistical work. You can do a lot of it or a little of it, but you must do some.

Measuring Price Risk

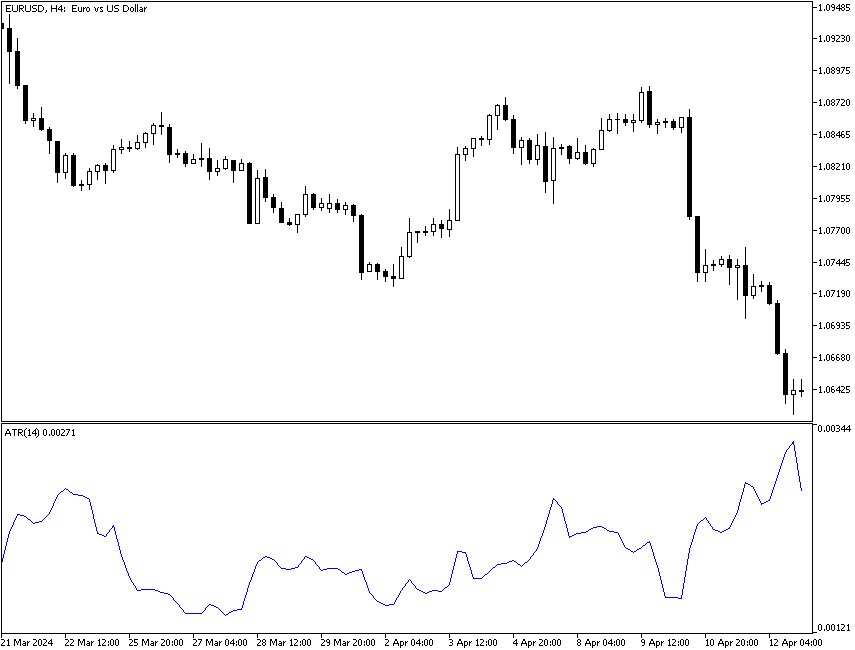

Let’s say you want to trade EUR/USD and think your holding period should be 240 minutes or H4 up to as long as one to three days. You plan to work on the H4 chart. The first question you need to ask is what the average high-low range is over a very large series of H4 chunks of time. This is not hard to do if your data source offers ATR, or average true range.

The chart below shows EUR/USD on the H4 chart with the ATR graphed below it. The price series is going up and going down — you will find that ATR can be influenced by the direction, so you want ATRs from both rising and falling trends. The ATR varies from a low of 0.00121 points to 0.00344 points per 14 periods, which is roughly 2.33 calendar days. This is not a bad starting point because now you know that per H4 period, you can expect an average of 23.3 points move with a low of 12.1 points and a high of 34.4 points. This will come in handy when you are setting stops and targets.

Another idea is “maximum excursion,” which looks back over vast amounts of historical price data and finds the biggest moves in the shortest time. Let’s say that three times over the past ten years, the GBP/USD moved 500 points in three weeks. You would consider 500 points your risk amount. Multiply that out by the number of lots you would be trading, assuming you might hold for as long as three weeks, to find your maximum loss. This is not something very many traders actually do, but it is certainly an interesting exercise.

Measuring Volatility

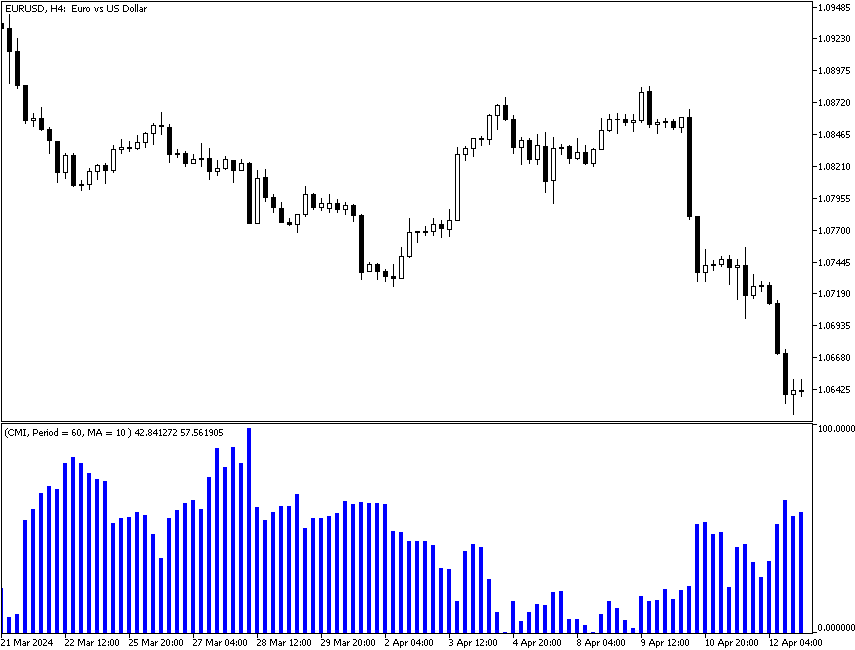

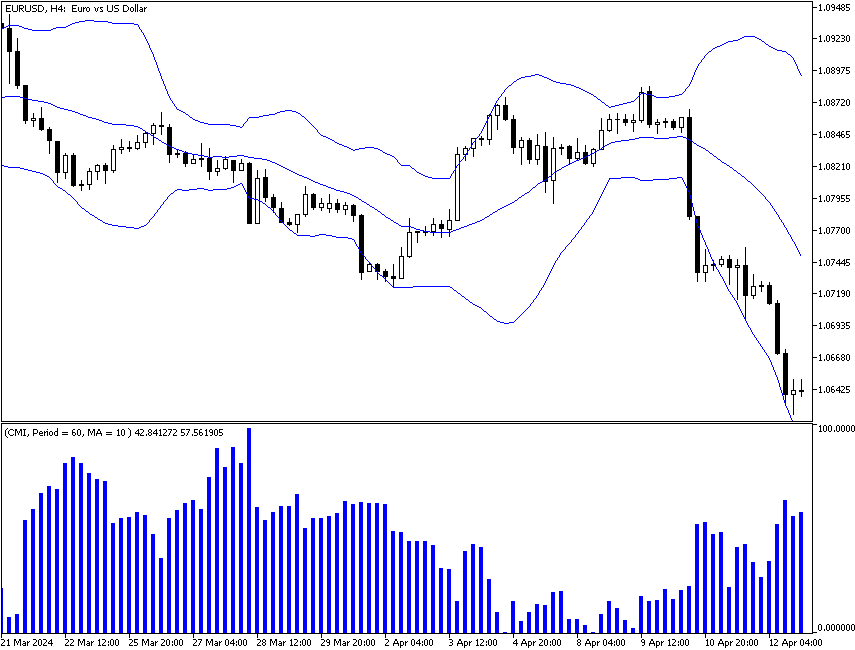

But it does not measure how quickly the price changes, i.e., how fast it changes direction. For that, you need an indicator called the “choppiness” indicator. Various versions of choppiness are available. This particular one is for MetaTrader 5. Choppiness is a function of market direction. A trending currency pair will have a low choppiness indicator value, while a trendless currency pair will have a high choppiness value. Choppiness may range between 0 and 100. The higher the index, the choppier the rate fluctuation is. The lower the index, the more trending the market.

Since Choppiness is a lookback indicator, it has a length, which sets its lookback period. The default one is 14 candles.

It is important to grasp that the Choppiness indicator is a judge of the trend, like the Average Directional Index or ADX, developed by Wells Wilder in 1978. The formulas are overly complex (for example, the degree of directional movement is calculated by comparing the difference between two consecutive lows with the difference between the highs). The important point is that when your price is trending, you are at less risk of a surprise adverse movement.

How do we interpret the data on the chart above? The first thing to notice is that the Choppiness indicator rises sharply after the downside breakout move on the left side of the chart and again ahead of the downside breakout move on the right side of the chart. This illustrates that when the market is moving fast, you are taking high price risk if you are in the wrong position. If you are in the right position, of course, volatility offers opportunity. Notice that in the right part of the chart, when the euro is range-trading and failing to match the previous highest high, volatility is also rising. This is like the Bollinger Bands contracting into a Squeeze. In fact, if you place Bollinger Bands on this chart, you will see the Squeeze just ahead of the downside breakout. The important thing to take away from the Choppiness chart is that it provides a measure of volatility and, therefore, price risk to you. When the volatility is low, you are taking less risk. When it is high, you are taking more.

We have numerous other ways to measure volatility, including the conventional standard, the standard deviation, and the standard error. For more on those two measures, see the lesson on Bollinger Bands and the one on Channels. The problem with both these measures is that to see them graphed on a chart offers no insight at all (and we are not showing them for this reason). Both statistical measures are more accessible to the trader’s eye when they are placed in context, as in the Bollinger Band and Linreg Channel.

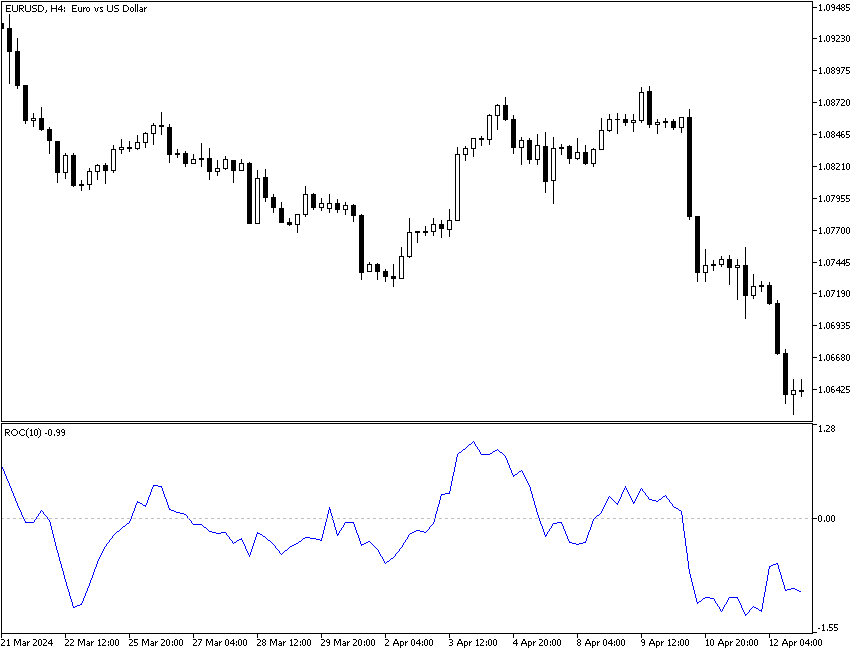

Another way to get a grip on volatility is with the Rate of Change, which is a simple indicator that shows the price today minus the price X periods back. You can tell your charting software to display it in points or as a percentage. Generally speaking, at this point you should be thinking in terms of points. See the chart below displaying the Rate of Change for the H4 timeframe. In this display methodology, the zero line marks where the close price of the H4 bar is unchanged from the closing price 10 periods earlier, or roughly 1.67 days since this is a 10-period lookback. The high in the center is 1.03, and the low on the right is 1.30, or a difference of about 26.2%. This means that if you had bought near the highest price high and failed to exit, your loss would be on the order of 26.2%. As a practical matter, it is doubtful that many traders actually use ROC to analyze the riskiness of their position, but it is not altogether without value to look at it once in a while.

Bottom line, to assess your risk of loss, you need to know the minimum, maximum, and average price change, and the speed of that change, over your expected holding period. It is of no use to consult percentage price change or rate of change for a daily holding period if your holding period is four hours or three days.