Descending Channel Pattern

Contents

What is a channel?

Channels are a popular tool that helps better identify a trend and predict price actions. A channel is a chart pattern, also called a parallel channel or equidistant channel, that consists of two parallel lines that connect consecutive swing highs and lows and contain prices between them. Channels are divided into three categories, depending on the direction of the price move within the pattern and the angle of the channel: ascending, descending, and rectangle. The present guide covers the descending channel pattern.

What is a descending channel?

A descending channel is directly opposite to an ascending channel — it is a chart pattern that consists of two parallel lines with a downward slope. It forms when the chart demonstrates consistently lower highs and lower lows. Usually, it is considered to be a bearish channel over the longer term, showing that prices are in decline. But it also can form within a longer-term uptrend, and in that case, it is usually just a sign of a correction between prices resume their upward movement.

How to construct a descending channel?

The construction of the channel starts with drawing the upper line (called the main trendline), which touches at least two highs, though the more the better. Then the secondary trendline is drawn along the lows. The upper line shows the area of resistance while the lower line points at the level of strong support. Usually, prices move within the channel, though sometimes they can move outside of the channel for a short while. Traders should be cautious of such false breakouts. Yet a real breakout can be considered a strong buy or sell signal. A downward breakout means that the downtrend is strengthening and is a bearish sign. An upward breakout suggests a trend reversal and is a bullish sign.

How to trade a descending channel?

There are two main strategies involving a descending channel pattern. One of them is to sell short when prices touch the channel's ceiling, though contrarian traders can also risk and set buy orders at the channel's bottom. Such a strategy is better to be employed in a low- or medium-volatility environment and on longer-term channels. This strategy considers the pattern to be a bearish one.

But a breakout is considered to be a stronger signal, therefore a more popular strategy is to wait for prices to break from the channel. While a breakout in any direction is considered to be a strong signal, traders prefer to trade a reversal breakout. In this case, traders wait for prices to break above the channel's ceiling to open long positions. If prices consistently fail to reach the lower border of the channel for a period of time while touching the upper bound of the channel, that suggests that the downtrend is weakening and an upside breakout is more likely. False breakouts are a danger, therefore consulting other technical indicators as well, like MACD or RSI, is a good idea. Traders may also require that a significant increase in volume should accompany a breakout. It is also can be prudent to not enter a position immediately after prices cross the border. It is usually suggested to enter a position at 10% of the channel's height above the upper border of the channel. The common profit-taking objective, in this case, is situated at the channel's height above the upper bound of the channel.

Descending channel examples

Here are two real-world examples of trading using descending channels, one which led to a successful trade and another one that did not.

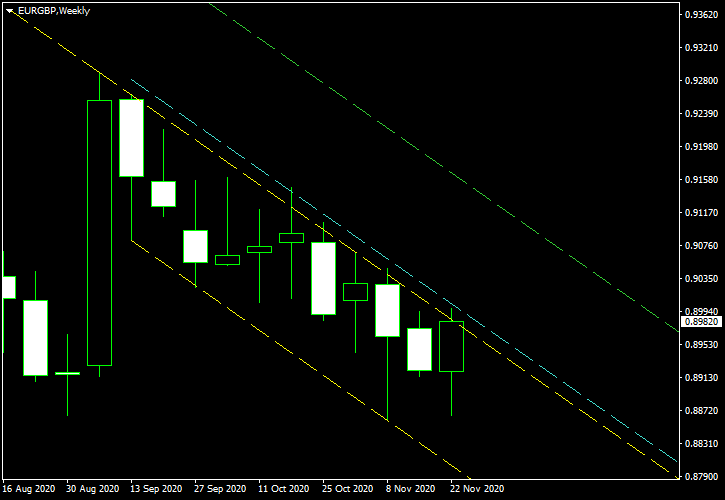

The first example shows a descending channel (indicated by the yellow lines), which had formed on the longer-term weekly chart of EUR/GBP in November 2020. Betting on an upside breakout, an entry point for a long position was set above the upper border at the level indicated by the cyan line, while the green line shows the intended profit-taking objective.

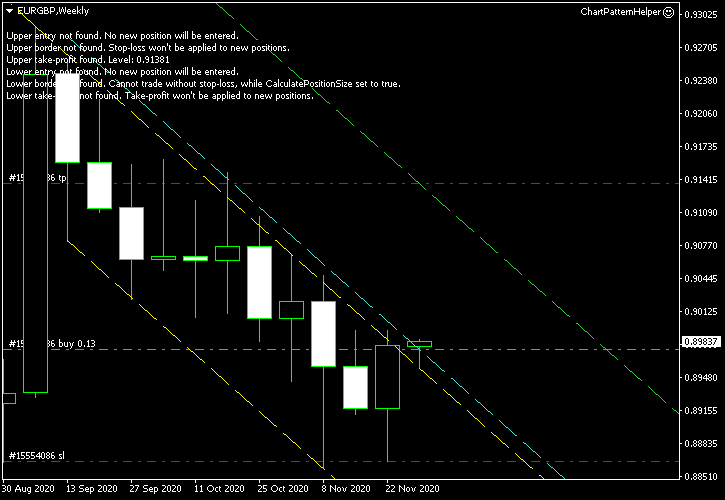

A successful entry for a long position was triggered after an upside breakout.

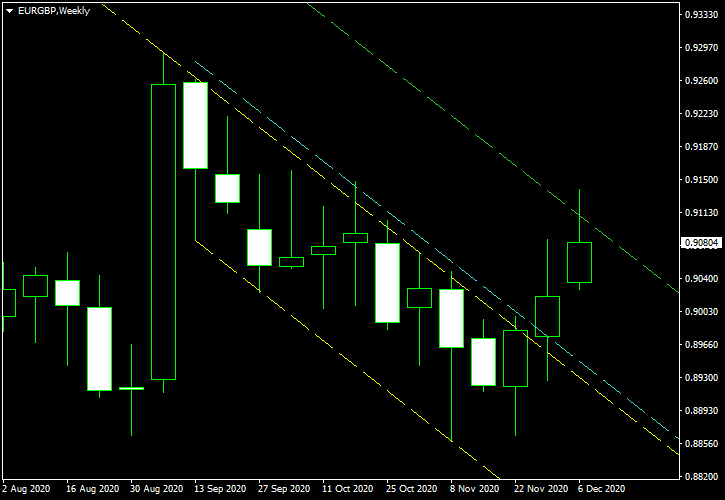

Prices continued to move further up, reaching the profit-taking objective and resulting in a successful trade.

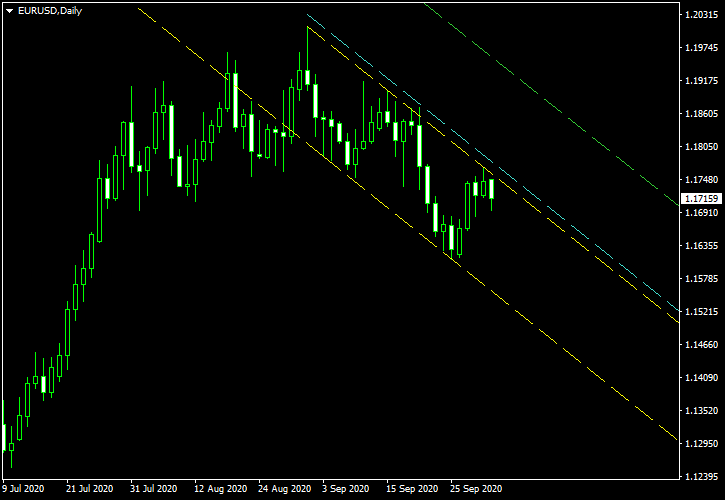

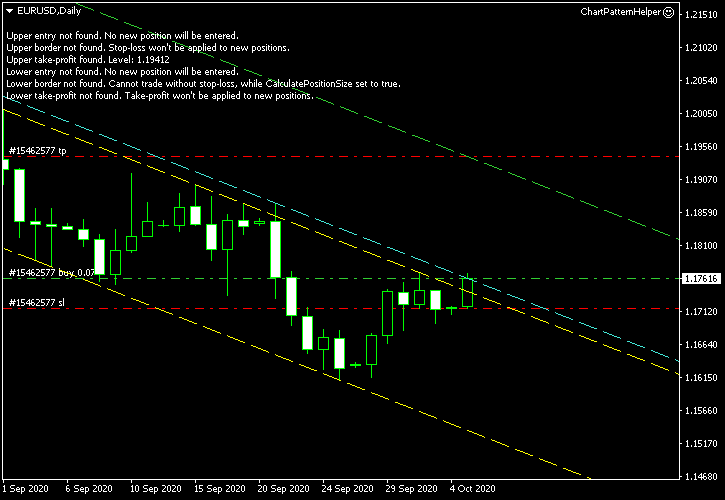

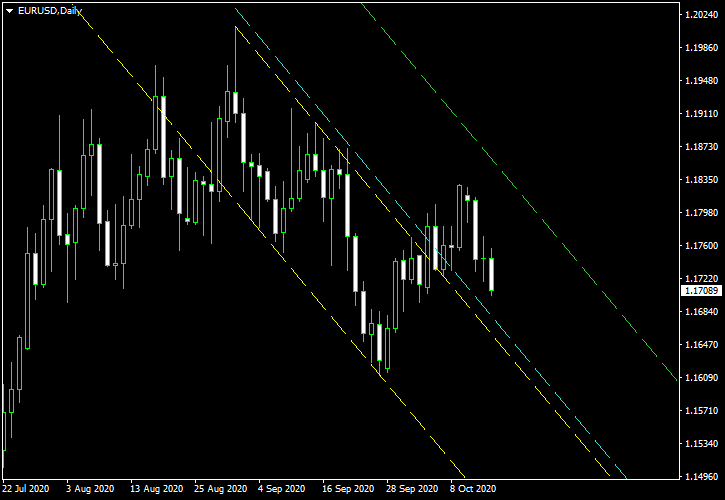

Another example is the descending channel that had formed on the daily chart of EUR/USD in October 2020. The lines have the same meaning as in the previous chart.

The currency pair reached the entry level the next day.

Alas, the upside breakout had lost its momentum and triggered a stop-loss.

Conclusion

A descending channel can help you identify a downtrend on a longer-term chart or a potential continuation of an uptrend on a shorter-term chart. In case of a breakout above the upper border of the channel, prices often continue to move higher for a while. But as shown in the examples above, it is not always the case. The pattern should not be used alone but rather in conjunction with other technical indicators or fundamental analysis, as with any other chart technique.

If you have some questions about descending channels or using these chart patterns in Forex trading, you can ask them on our forum.

If you want to get news of the most recent updates to our guides or anything else related to Forex trading, you can subscribe to our monthly newsletter.