Central Banks' Control of Foreign Exchange Rates

The ever increasing number of international transactions demands smooth settlement process, which involves conversion of one currency into another. The Forex market prevails primarily for this purpose. However, the disequilibrium in the demand and supply of currencies in the global arena causes continuous fluctuations in the exchange rate of currencies.

Since the exchange rate is directly linked to the economic stability, the central banks of all the countries closely monitor the forex market and take adequate actions, whenever needed, to protect the vested interests of the country they represent. In this regard, the central banks play a major role in setting the currency exchange rates by altering the interest rates. By increasing interest rates the central banks indirectly (on the basis of high return on investment) stimulate traders to buy the respective country’s currency. This process drives the value of the corresponding central bank’s currency higher in comparison to other currencies.

However, the action discussed above is only one of the methods adopted to keep the currency exchange rate stronger. There are several other complex methods implemented by a central bank to prevent an economy from ailing. Before the strategies are discussed, it is vital to understand the basics of foreign exchange mechanism.

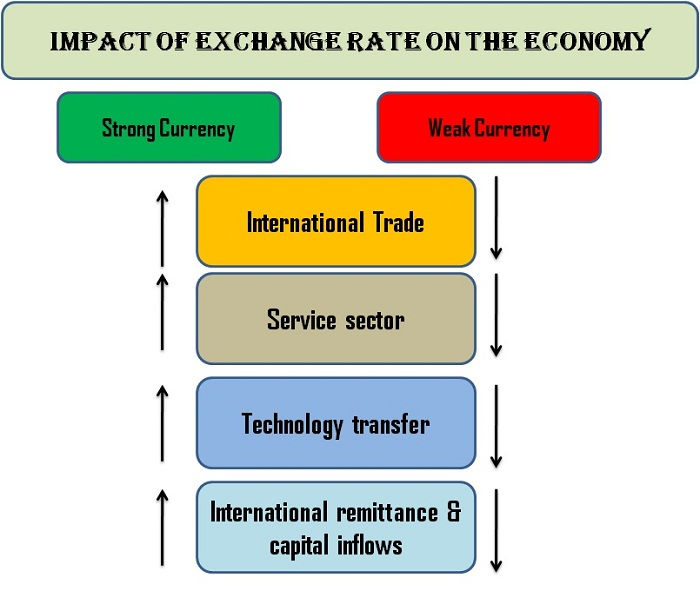

Impact of foreign exchange rate on economy

The currency exchange rate of a country directly and indirectly affects the various segments of a country’s economy in the following manner:

a. International trade

Industrial sector can grow only when a country has adequate foreign exchange. When the exchange rate is poor, the value of goods which can be purchased for every dollar equivalent of currency will largely decrease. This would deplete the foreign exchange resources quickly. In turn, a lack or shortage of foreign exchange would create difficulty in importing essential goods, raw materials, and much needed machinery. When vital goods fall short of requirement there won’t be any surplus good available for export. This would cause a spiraling effect on a country’s economic growth.

b. Service sector

The local economy benefits when the currency exchange rate of a country is stronger. The reason is that overseas clients need to spend more to purchase one dollar equivalent of service (tourism, banking etc.).

c. Technology transfer

A country with a strong exchange rate will have better bargaining power. Additionally, it becomes easier to purchase high end technologies without draining the foreign exchange reserves.

d. International remittance & capital inflows

A country with a strong currency will not default from its debt obligations. Thus, investors will have no issues in getting dividend / profit remittances. This would encourage capital inflow thereby strengthening the local economy further.

Different ways of expressing exchange rates

The exchange rate is the value at which the currency of one country is converted into currency of another country. There are different ways of expressing exchange rates. They are:

a. Normal and actual rate

The rate set by the foreign exchange controlling forces (Central bank for example) is called the normal or true rate. The rate determined by the market forces on the basis of demand and supply is called the actual rate. The actual rate revolves around the normal rate.

b. Spot and forward rate

The exchange rate at which a currency is delivered immediately to a buyer is called the spot rate. On the other hand, the exchange rate at which a currency is delivered at a future date is called the forward rate.

c. Single and multiple rates

Usually, there exists only a single exchange rate for a country’s currency. However, in rare occasions, a country may adopt one, two or even three different exchange rates against the currency of another country. For example, a country may have different conversion rates for exports and imports.

d. Buying and selling rates

The dealers (banks, financial institutions) operating in the forex market will offer lower and higher rate respectively to clients approaching to sell and buy a country’s currency. The lower rate offered is the buy rate while the higher rate quoted is the sell rate.

e. Favorable and unfavorable rates

If the currency exchange rate increases with respect to the currency of another country then it is called as favorable rate and vice versa.

f. Official and unofficial exchange rates

It is the predetermined exchange rate based on which an international transaction is carried out. If the cross-country business is carried out at an exchange rate determined by outside market forces then the exchange rate is referred to as unofficial exchange rate.

g. Fixed and flexible exchange rates

If the currency exchange rate is maintained artificially through intervention or otherwise, at a predetermined level, then it is called as the fixed exchange rate. If the currency exchange rate is allowed to be determined by the market forces then it is called as the flexible or floating exchange rate.

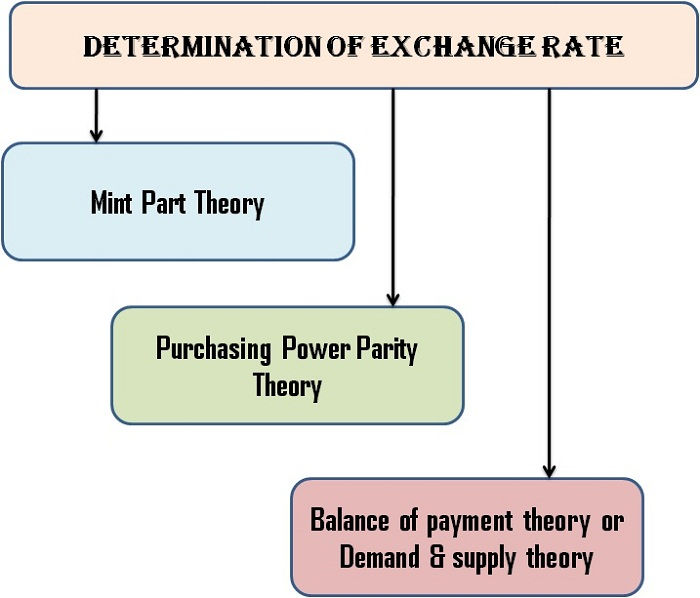

How exchange rate is determined?

Over the course of time, three theories were put forth by economists and think tanks for the determination of foreign currency exchange rates. They are:

a. Mint part theory

The theory is based on the Gold Standard. A country following Gold Standard will also have its currency in gold or convertible into gold at a fixed rate. Additionally, the currency will also have a fixed ratio relationship (mint par exchange or mint par of excellence) with currency of another country following the gold standard. Presently, the gold standard is not followed by any country. Thus, mint par theory has lost its significance.

b. Purchasing power parity theory

The theory was first arguably refined and put forth in presentable form by the Swedish economist Prof. Gustav Cassel in 1922. This theory for paper currency states that the rate of exchange of two currencies should match the quotient of their respective internal purchasing power.

From the theory, it can be inferred that the price rise in a country brings down the value (or purchasing power) of its currency. Even though the theory can be applied to all currencies, it neglects other external factors (speculative activities, capital inflow/outflow etc.) which would impact the exchange rate.

c. Balance of payment theory or demand and supply theory

As per this modern theory of exchange, which is currently accepted as the standard, the rate of exchange equates to the demand and supply of foreign exchange. Furthermore, the rate of exchange is the price point where there is equilibrium between the forces of demand and supply.

When there is a surplus in the balance of payments the demand and consecutively the rate of exchange will decrease due to unhindered flow of foreign exchange. On the other hand, a country with a negative balance of payment will struggle to manage the foreign exchange reserve needs. Correspondingly, the demand and rate of exchange will increase.

The theory is comprehensive, practical and realistic. Even though the theory is widely accepted, still it suffers drawbacks from assumptions related to balance of payments.

Why exchange rate changes often?

Several factors contribute to the volatility of foreign exchange rate. They are:

- Gradual or abrupt change in the foreign exchange demand and supply scenario.

- Changes in the volume of imports and exports.

- Amendments in the monetary policy of a country.

- Capital inflow and outflow from industries, stock market etc.,

- Changes in the economic conditions (inflation, deflation)

- Geo-political changes.

- Changes in the banking sector.

- Rise or fall in the average household income will contribute indirectly to a change in the exchange rates.

- Overall sentiment.

- Activities of speculators.

- Huge technological advancements will gradually affect the exchange rate in a positive manner.

Meaning of exchange control

Foreign exchange control refers to the process of restricting transactions involving foreign exchange either by a government or the central bank. When foreign exchange control is in force the market forces will not be able to operate freely because of the restrictions imposed. Thus, the rate of exchange would differ from the one that will exist in the free market scenario.

Usually, weaker economies tend to employ foreign exchange control. It is done with an intention to achieve economic stability. In fact, the International Monetary Fund has a specially laid out provision named article 14, which strictly allows only transitional economies to implement foreign exchange controls. Notwithstanding the provision, in the modern era, to shield the economy from unexpected currency exchange rate volatility, almost all countries employ foreign exchange controls in some form or the other.

Characteristics of foreign exchange control

When a government or central bank regulates the inflow and outflow of foreign exchange then the prevailing economic system will exhibit the following characteristics:

- All kinds of international transactions involving foreign currency would remain centralized.

- The central bank will retain a monopoly over the buying and selling of currencies in the Forex market.

- A license from the central bank will be a must to operate as a foreign exchange dealer.

- The central bank will reserve the right to prioritize foreign exchange allocation for different obligations.

- The central bank will purchase the inward remittance from all kinds of international transactions (exports and repatriation of all kinds) and provide domestic currency in return.

- The central bank will determine and manage the official rate of exchange.

- Importers must provide a long list of relevant documents for the purchase of foreign currency from the central bank.

Need for foreign exchange control

Theoretically there is no limit for the rise or fall of a paper currency. Thus, adverse changes in the exchange rates will create unmanageable economic instability. When the currency of a country strengthens (rise in the exchange rate) there will be positive effects (rising productivity, lower unemployment, high economic growth, incentives to cut cots etc.,) overall. However, if a currency becomes stronger because of speculative activities then it would lead to a recession. Swiss Franc is a classic example for a speculation driven currency. Problems in the USA and the Euro zone naturally lure investors to Switzerland, which is considered as a safe haven for investments. Thus, Swiss Franc often sees fundamental overvaluation and the central bank should intervene to prevent the country from falling into recession.

A weak currency will have undesirable effects on the economy. It will adversely affect imports and capital inflows, which form the nerve center of any healthy economy. Thus, no responsible central bank will allow its currency to fall freely. With a weak currency in place, no country in history has successfully come out of debt or recession.

Considering the facts mentioned above, it becomes very important to closely monitor the exchange rate and intervene, if necessary, to keep the economy healthy and growth oriented.

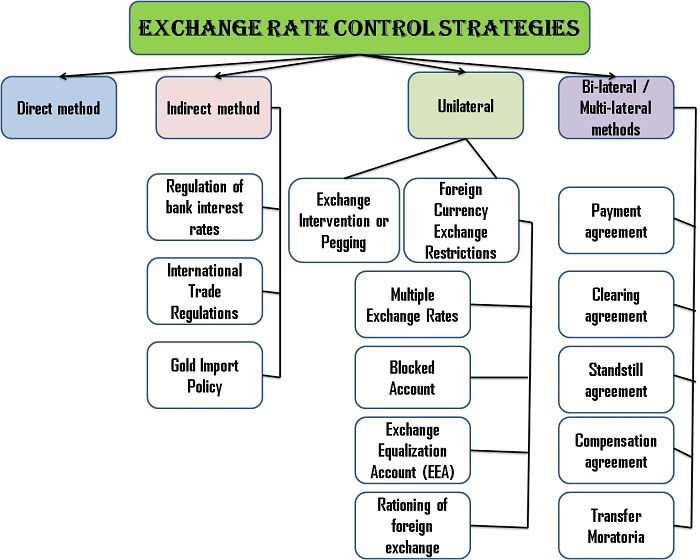

Strategies adopted by central banks to control exchange rates

Basically, all the methods adopted to implement exchange rate control can be classified under two groups. They are:

a. Direct and indirect methods

If the exchange control strategy affects the conversion rate straight away then it is called as the direct method. If the tactic affects some other sector but finally influences a change in the exchange rate then it is called as the indirect method.

b. Unilateral, bilateral and multilateral methods

Unilateral methods are strategies implemented by the central bank of a country without taking into consideration the opinion of other countries. Bilateral and multilateral methods are those exchange rate control mechanisms applied with mutual consent of two or more countries.

Unilateral methods

a. Exchange intervention or pegging

It is a soft form of intervention in the market. As per this strategy, the central bank of a country will intervene in the market to bring the exchange rate to a desired level, if there is a concern about speculators driving the price too high or low.

If the central bank buys the currency with an intention to increase the exchange rate then the currency is said to be pegged up. Similarly, the currency is stated to be pegged down when the central bank intervenes in the market to decrease the exchange rate. It should be noted that the intervention will not cause permanent trend change.

b. Foreign currency exchange restrictions

By controlling the demand and supply of currency, the central bank of a country can influence the exchange rate. The following are the widely adopted measures to keep the exchange rate under check:

i. Blocked account

The bank accounts of foreigners are blocked under this system. If there is a dire necessity the central bank will even transfer funds from all the blocked accounts into one single account. However, it will create bad impression about the country thereby leading to lasting negative effects on the economy as a whole.

ii. Multiple exchange rates

Under this system, a central bank will have total control over the foreign currency and offer different rates for purchase and sale by the importers and exporters respectively. This is done to control the capital outflow from the country. It can be construed as rationing of foreign currency by price instead of volume. The system is complex and only creates additional headaches to the central bank.

iii. Rationing of foreign exchange

In this method, the control over foreign exchange will solely lie in the hands of the central bank, which will decide the quantum of foreign exchange to be distributed for every incoming request. No individual or corporate can hold foreign currency. Only urgent needs would be considered.

iv. Exchange Equalization Account (EEA)

To control short-term volatility in the exchange rate, the central bank of UK, following the exit from the Gold Standard, created a fund named Exchange Equalization Account in 1932 to prevent unwanted volatility in the exchange rate of Pound Sterling. The strategy was later adopted by USA (Exchange Stabilization Fund) and other European countries including Switzerland and France.

Bilateral and multilateral methods

a. Payment agreements

Under this system, the debtor and creditor country enters into a payment agreement to overcome the delay in the settlement of international transactions. The agreement will stipulate the methods to be followed for controlling the exchange rate volatility. Usually, the method includes but not limited to the controlled distribution and rationing of the foreign exchange.

b. Clearing agreements

This exchange rate control strategy is implemented through an agreement between two or more countries. Based on the agreement, the exporters and importers respectively will receive proceeds and make payments in their domestic currency. For this purpose a clearing account with the central bank is used. Thus, the need for foreign exchange is avoided, which in turn reduces the exchange rate volatility. The system was used by Germany and Switzerland during great depression in 1930.

c. Standstill agreements

Under this system, through a moratorium, a central bank converts short term debt into long-term debt. Such a process offers adequate time for repayment. This removes the downward pressure on the exchange rate. The system was implemented by Germany in 1931.

d. Compensation agreement

The process involves a barter agreement between two countries. One country will be a net exporter and other one will be a net importer. The value of exports and imports will be equal. Thus, the need for a foreign currency is avoided and the exchange rate remains stable.

e. Transfer moratoria

Under this system, the central bank bans all kind of payments to creditors abroad. The debtors should make domestic currency payment to the central bank, which will disburse funds when there is overall improvement in foreign exchange reserves.

Indirect methods

a. Regulation of bank interest rates

When bank interest rate is increased, capital inflow (through foreign investors) goes up. This will increase the demand for domestic currency thereby making the exchange rate stronger. The opposite scenario happens when the interest rate is lowered. Thus, whenever it is necessary, the central bank indirectly controls the exchange rate by altering the bank interest rates.

b. International trade regulations

When the balance of trade becomes unfavorable, a government can impose import restrictions through a series of measures (tough clauses, changes in policy, quota system and additional tariffs). Simultaneously, exports can be promoted (international business exhibitions, subsidies etc.). This will ultimately make imports unattractive and boost exports. The net gain in the foreign exchange reserves will obviously strengthen the exchange rate.

c. Gold import policy

Barring few countries in Africa, almost all others are net importers of gold. By restricting (increasing import duties) the import of gold, the exchange rate can be altered. This tactics is often used by India, which imports about 700tons of gold every year. When import decreases, foreign exchange reserves increases thereby resulting in a better exchange rate.

Practical examples

Whenever situation demands, to stabilize currency exchange rates, major central banks intervene in the Forex market. Provided underneath is a partial history of interventions by major central banks across the globe.

History of floating exchange rate interventions by major central banks

| Year | Currency | Nature of intervention by central bank | Reason |

| 1978-79 | US dollar | Fed buy | High oil prices, declining balance of payments, high inflation |

| 1980-81 | US dollar | Fed Sell | Strong dollar discouraging exports |

| 1985 | US dollar | Fed Sell (soon after Plaza accord) | Strong dollar |

| 1987 | US dollar | Fed Buy (soon after Louvre accord) | Weak dollar, deteriorating economy |

| 1988-90 | US dollar | Fed Sell (after G7 meet) | Strong dollar |

| 1991-92 | US dollar | Fed Buy ($2.5B) & Sell ($750 mill) | Gulf war – Dollar weakens |

| 1994-95 | US dollar | Fed Buy (in co-ordination with European banks and Japan) | Weak dollar following Gulf war |

| 1998 | JPY | BOJ Buy (supported by US Fed) | JPY weakens to hit 144Y to a US dollar forcing BOJ to intervene. |

| 1999-2000 | JPY | BOJ direct sell (16 times). Through US Fed and ECB once. | Strong JPY (108Y to a dollar). The intervention is a failure since JPY continued to strengthen (102Y to a US dollar) |

| 2000 | Euro | ECB (in tandem with US Fed and BOJ) | Euro weakens to historical low (0.86 to USD – a decline of 30% since the introduction of the Euro in 1999). |

| 2001 | JPY | BOJ sell (in unison with ECB and US Fed). | Strong Yen crushing exports. |

| 2002 | JPY | BOJ sell | BOJ sold Yen to prevent further weakening of the US dollar, which hit 7-month low (121.5Y to a dollar). |

| 2003 | Yen | BOJ sell (bought US dollar and Euro) | A record 20 trillion Yen intervention in a single year to prevent the US dollar (still the Yen strengthened from 115Y to 107Y to a dollar) from further weakening. |

| 2004 | Yen | BOJ sell | 14 trillion Yen sold in 47 days. To aid the weakening of Yen, Ministry of Finance also sells 5 trillion worth of foreign currency bonds under a repo deal to BOJ. |

| 2007 | NZD | NZ dollar sell | NZD (hit 22yr high) became fundamentally overvalued (demand for high-yielding currency strengthened NZD) |

| 2009 | CHF | SNB sell (brought Francs down to 1.54 per Euro) | The Swiss National Bank sold Francs and bought the Euro in an effort to weaken the former (CHF was trading at 1.4576 to a Euro dollar). |

| 2010 | CHF | SNB sell (to weaken CHF against the Euro) | CHF hit all time high of 1.40 per Euro raising concerns among the economists. |

| 2011 | CHF | SNB sell (support the Euro) | Devaluation commenced to keep Swiss economy competitive and avoid deflation. |

| 2015 | CHF | SNB will no longer support the Euro. (effectively un-pegged Swiss Franc) | The SNB had amassed foreign currency reserves to the tune of 480 billion constituting 70% of the nations GDP by then. Swiss Franc had already depreciated by 12% against the Euro. |

Evolution of currency exchange control rate in important countries

Brazil

- A “crawling pegged” system was followed from 1967 to 1990 (barring a brief period of fixed regime in 1986) to maintain export competitiveness. The central bank also created new currencies (Cruzeiro, Cruzado, Novo Cruzado) often in response to high inflation.

- The central bank adopted band based floating exchange rate system (with minor central bank intervention) from 1990. However, the inflation continued its upward march. In the meanwhile, the central bank continued to introduce new currencies (Cruzeiro, Cruzeiro Real, Real).

- The central bank abolished all prevailing unsuccessful methods and adopted a full-fledged independently floating exchange regime, following the currency crisis in 1999.

China

The Chinese currency had undergone a huge transition in the last four decades.

- The People’s bank of China adopted a dual-track currency system in 1978. Under this system, only the local population is allowed to deal through Renminbi while the non-residents should use foreign exchange certificates.

- Following a period of economic growth, the Chinese government slowly moved towards a convertible (current and not capital accounts) system in the next ten years (1980-1990).

- Until 2005, the currency remained pegged to the US dollar.

- Since 2006, the Renminbi is allowed to move between narrow bands set around a base rate determined by the basket of world currencies.

- By the second half of 2012, following the actions taken by the Chinese government, the Renminbi started trading within 8% of it actual value. It is now in the list of top ten traded currencies.

India

- Until 1973, the central bank (Reserve Bank of India) kept the Rupee linked to the Pound Sterling.

- From 1975 onwards, a managed floating exchange rate system, linked to a basket of currencies (major trading partners’), was followed.

- Increased trade deficit led the RBI to devalue Rupee twice in 1991. The central bank also adopted the Liberalized Exchange Rate Management Systems under which a dual (effective and market) rate was followed.

- From 1993, market determined unified exchange rate is followed.

Malaysia

- The Bank Negara (central bank of Malaysia) replaced Pound Sterling with the US dollar as the intervention currency in 1972 and established an effective rate of exchange.

- A year later the central bank placed the effective rate on a controlled floating basis.

- To maintain uniformity in the exchange rate and shield the economy from external turbulences, the central bank of Malaysia started using an effective rate calculated on the basis of an undisclosed basket of currencies.

- Following the Asian crisis in 1998, the currency depreciated sharply. To save further weakening of the currency, the prevailing system was dismantled and a shift back to the fixed exchange regime was done (3.80 Ringgit to a US dollar).

- When China floated its currency in 2005, Malaysia followed suit within an hour.

South Africa

Most of South Africa’s exchange control measures were taken to resolve the external pressures.

- The first exchange control measures were taken in the year 1961 on account of deterioration of the capital account of balance of payments. Based on this control, the repatriation of proceeds of non-resident owned securities was not allowed.

- The Finance Rand System was introduced in 1978. The system laid down the terms and conditions under which a transfer or re-investment of proceeds of sale of assets can be done.

- The SARB (South African Reserve Bank) abolished the non-residents exchange control in the year 1983 but re-introduced two years later. There was a dual-rate rand exchange system, with the commercial rand rate set by current account transactions, while the financial rand rate was set by capital account transactions. Both types of currency were on a floating system, however, the financial rand traded at a discount to the commercial rand.

- Ten years later (1995), all exchange controls over non-residents were abolished. Additionally, private investors were allowed to invest offshore. Initially, the amount was limited to R200k but raised incrementally to R2m.

Venezuela

Following a mass protest to topple the Venezuelan government in 2003, CADIVI (Commission for the Administration of the Currency Exchange) put forth exchange controls to prevent capital flight from the country.

- Under the system, both private and public sector entities should sell and buy foreign currency (USD) from the CADIVI. Even the Petroleum of Venezuela (PDVSA), which is the major source of foreign currency, had no right to retain the inward remittance for export of oil and gas.

The exchange rate was initially fixed at BsF 4.28 / BsF 4.30 to a dollar.

- Since the efforts to resolve the currency crisis did not succeed, the Venezuelan government created another currency named Bolivar Fuertes (VEF) and pegged it officially higher against the US dollar. With no respite for the economic woes, the value of Bolivar declined and the demand for dollar increased.

- In April 2013, the government abolished previous exchange control practices and implemented Complementary System of Currency Administration. The currency was devalued by 46.5%. Currently, the currency selling range stands between 4.30 VEF and 6.30 VEF while the allowed buying range is from 4.28 VEF to 6.28VEF.

Swiss Franc

- To protect the Swiss economy from the Euro debt crisis, in 2011, the SNB (Swiss National Bank) announced that it would no longer allow the Swiss Franc to appreciate further against other currencies and in particular against the Euro.

- The SNB also stated that it will purchase unlimited amount of other foreign currencies to keep the Swiss Franc competitive. A maximum appreciation limit of €0.83 (for one Swiss Franc) was set by the SNB authorities.

- The unexpected devaluation (& pegging against the Euro) sent the Swiss Franc down by more than 9% in less than 15 minutes. The SNB clarified that such a decision was taken to protect the Swiss economy from deflation.

- Four years later, on 15th Jan, 2015, again, in an unexpected move, the SNB un-pegged the Swiss Franc from the Euro. The move created panic not only among the retail traders but also among the major financial institutions. Several banks, hedge funds lost millions of dollars in few minutes. Even reputed forex brokers were wiped away. The SNB explained that the decision was taken because of the fear (ill-informed) about hyper inflation in Switzerland, the ECB’s 1.1 trillion economic stimulus program & depreciation of the Swiss Franc against the Euro and Indian Rupee (India is a major importer of Swiss products).

- What concerned everyone was that there was not even an iota of indication about the forthcoming decision. Probably the only person who guessed (in his book titled ‘Street Smarts’) it right was Jim Rogers, the well-known commodity investor and co-founder of Quantum Funds.

There are around 66 countries, which include Hong Kong and Saudi Arabia, following a pegged currency regime. There is also the story of South Korea, which was forced to shift from a pegged exchange rate system to a free floating exchange rate system because of the pressure on Won (South Korean currency) triggered due to Thailand’s sudden shift to free floating exchange rate regime.

On the other hand, Iranian Rial is a classic case of currency manipulation orchestrated by the government. When the Iranian government lost its ability (due to imposed sanctions) to keep the Rial high through the use of petrodollar, the currency started declining dramatically. The Iranian currency had declined from 68.75 Rials to a dollar to 35,000 Rial to a dollar in less than three decades. Most of the erosion took place in the last five years.

Advantages of foreign exchange control

- Results in exchange rate stability.

- Enables correcting adverse balance of payment scenario.

- Prevents depletion of gold reserves and foreign exchange reserves.

- Preserves capital flight.

- Fuels economic growth and stability.

Disadvantages of foreign exchange control

- Indirectly increases the level of administrative corruption.

- A large number of competent officials are required to manage the smooth functioning of the economy.

- Creates misunderstanding with major economic powers.

- Multinational companies are discouraged from making large commitments.

- By and large, fundamental disequilibrium is created.

- Volume of international trade declines as a whole.

Exchange control measures can be considered as a double-edged sword. There may be situations where exchange control measures would be temporarily necessary. However, stringent and hasty decisions can put a country’s economy into an unrecoverable financial chaos.

History has proven that only those countries with liberalized exchange control mechanisms ward off financial difficulties at the earliest and register remarkable economic growth. After all, the nature of human being is to break away from any kind of restrains and exchange control is no exception to that.

- http://www.economicshelp.org/blog/9328/business/effect-exchange-rate-business/

- http://www.economicshelp.org/blog/3457/currency/problems-of-a-strong-currency/

- http://investmentwatchblog.com/a-weak-currency-is-a-curse-not-a-cure/

- https://www.slideshare.net/ArchitJha/foreign-exchange-controls

- http://www.preservearticles.com/2011092013740/what-are-the-major-types-of-exchange-rates.html

- https://www.bis.org/publ/bppdf/bispap24v.pdf

- http://www.forexfraud.com/forex-articles/pegged-currencies.html

- https://www.gatestoneinstitute.org/3597/iran-rial-collpase

- https://www.cato.org/blog/irans-lying-exchange-rates

- http://www.reuters.com/article/us-markets-intervention-timeline-idUSTRE64N3PA20100524

- http://www.preservearticles.com/2012012721767/what-are-the-methods-of-exchange-control.html

- https://economics-the-economy.knoji.com/indirect-methods-of-exchange-control/

- http://business-finance.blurtit.com/102219/what-are-the-methods-of-exchange-control

- https://www.slideshare.net/ImaginAttic/sarb-and-exchange-controls

- http://www.pwc.com/gx/en/tax/newsletters/pricing-knowledge-network/venezuela-currency-devaluation-exchange-control-regime.jhtml

- http://www.247bull.com/why-iran-is-experiencing-hyperinflation-we-could-too/

- http://www.esciencecentral.org/journals/exchange-rate-and-central-bank-intervention-economics-2-e104.php?aid=23738

If you want to get news of the most recent updates to our guides or anything else related to Forex trading, you can subscribe to our monthly newsletter.