How the Law of Large Numbers Affects Forex Traders

The law of large numbers (LLN) is a theorem from mathematics, which states that as the number of trials for testing some probabilistic outcome increases, the average of the obtained results becomes closer to the expected value. In other words, the more measurements you have in your sample, the more confidence you have in your results. Although a rare Forex course does not mention the importance of learning the basics of math statistics and probabilities, they rarely focus on the LLN and its significance to practical trading.

Examples

A toss of a coin

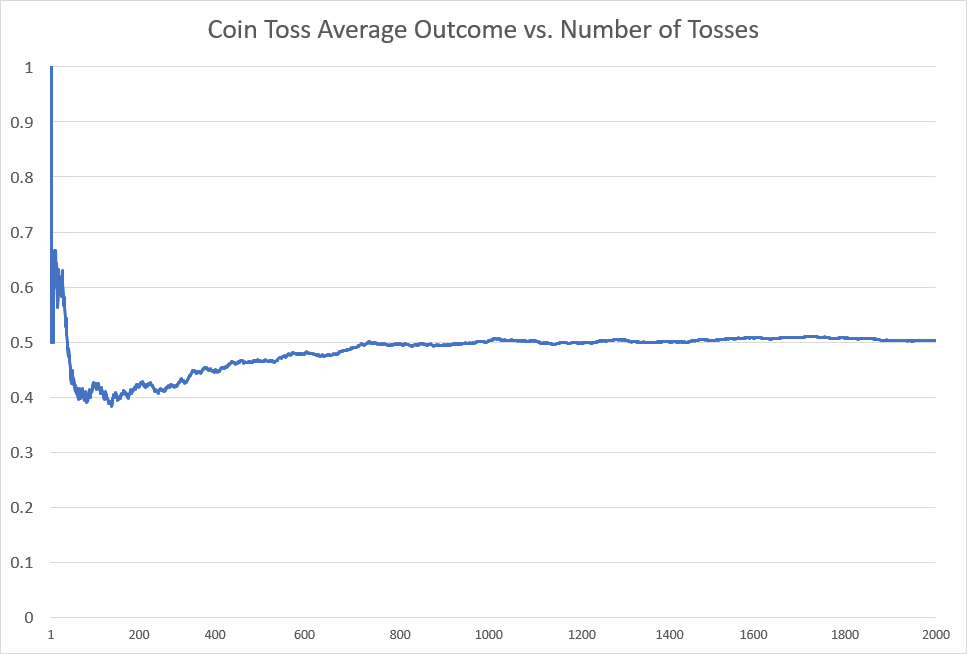

A basic example of the law of large numbers is a sequence of coin tosses. When you toss up a coin and see how it lands, you either get heads or tails with equal probability of 50% each. However, if you toss it just one or few times, the average outcome might be quite different from the equal number of heads and tails. Nevertheless, thanks to the LLN, the more tosses your produce, the closer the average outcome becomes to 50%. On the chart below, you can see how the average value of the coin toss outcomes (where 0 is heads and 1 is tails) becomes closer to 0.5 as the number of experiments grows:

Profitable trading strategy

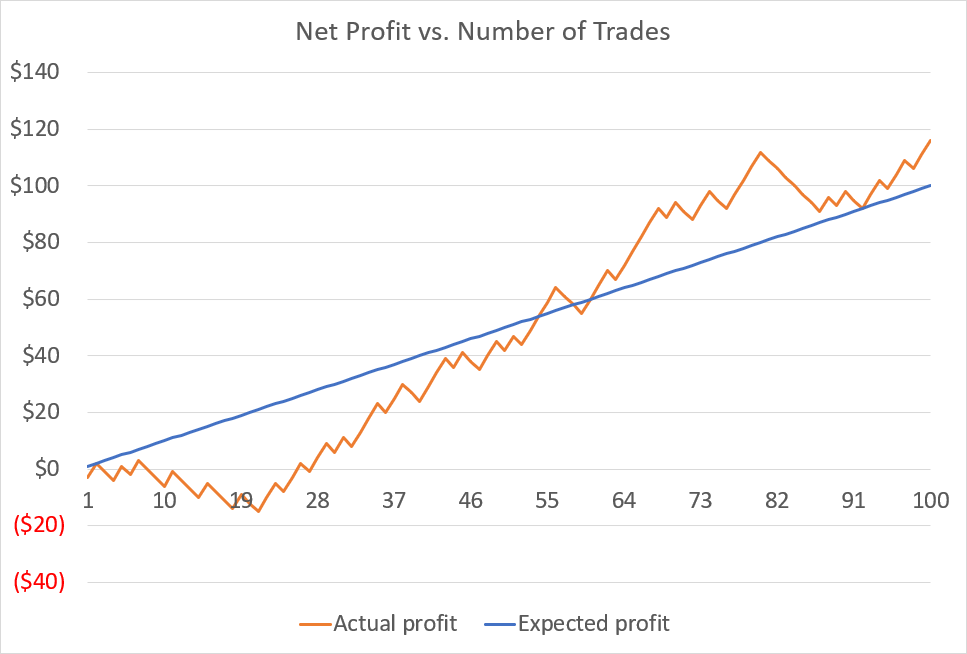

Another example comes directly from currency trading. Suppose, you have a profitable strategy with equal chance of winning and equal chance of losing (Pw = Pl = 0.5), but each losing trade is just $3, while each wining trade is $5. The expected profit per trade is 0.5 × $5 - 0.5 × $3 = $1. The chart below demonstrates potential net profit from a series of 100 trades. It plots the total net profit (orange line) versus the expected total net profit (blue line):

As you can see, if you made only first 20 trades from this series, you would be in a $12 loss. However, as the number of trades increases, the orange line, which represents the sum of actual profits, runs closer to the blue line, which represents the expected profit. At 100 trades in this series, the total net profit is $116 - quite close to the expected profit of $100.

Implications

There are four main consequences of the law of large numbers that influence traders in different ways:

- Strategy testing. You have to test your strategy on as long periods as possible to produce as many test trades as possible for the results to be reliable. What if you come up with a great strategy but test it only 10 trades and get results similar to those above? Or, test a really poor strategy and get a lucky streak of 10 trades? As a trader, you should only trust tests that produced a large number of trades. Unfortunately, it is not always possible, especially when dealing with long-term trading strategies.

- Deciding between two strategies. When you have two backtested strategies that are both profitable, and one trades much more frequently than the other, it is always better to stick to the former. The calculated expectancy (average profit per trade) might be better with the latter (a strategy with smaller number of trades), but the LLN suggests that we would get more consistent results with the first strategy.

- Aim for more trades. You can do it by applying your trading strategy to more currency pairs or by using several trading strategies at once. But, of course, in no case at all should you over-trade to increase the number of trades - that's just suicidal. Also, when you are adding new currency pairs to your list of trading instruments, make sure your strategy does not produce correlated trades on them (e.g., buying EUR/USD and GBP/USD at the same time). And when trading with more than one strategy at once, the same correlation issue should be observed too - ideally, your strategies need to be completely independent.

- Broker reviews. While application of the LLN to FX broker reviews doesn't seem as obvious as the above-mentioned cases of the LLN affecting us, traders, it is also a totally valid case of large numbers being superior to small numbers in the foreign exchange industry. As a trader who is in search of a broker to open an account with, you would be better off ignoring brokers that have just few reviews - be they good or bad, you need a big number of comments to draw a reliable conclusion about a company. Naturally, this would eliminate brand new brokers from your field of view (as they cannot have too many reviews initially), but this would also ensure that you work with a trustworthy institution, lowering your counterparty risk.

Conclusion

You do not have to be a math expert to understand the implications of the law of large numbers on trading. But such understanding is vital to become a knowledgeable trader who is able to analyze trading results reasonably and navigate in the world of online Forex safely.

If you want to get news of the most recent updates to our guides or anything else related to Forex trading, you can subscribe to our monthly newsletter.