Forex: Where to Put Stop-Loss?

Your first responsibility as Forex trader is to protect your trading account from being obliterated by Forex losses and the best way to ensure this does not happen is to use a stop-loss order to limit your risk exposure. However, knowing that you have to put a stop-loss order on every trade you take is not enough to turn you into a profitable trader given that you have to have the right size of a stop-loss distance to ensure you stay long enough in a trade to see price move in your chosen direction.

The bad news is that there is no simple answer as to where you should put your stop-loss in Forex trading as this depends on a number of factors that we shall cover in detail that should help you determine the right place to put your stop-loss.

The cardinal rules for stop-loss order placement

There are certain principles that you should follow when deciding where to place your stop-loss. You may apply one principle when placing a long-term trade such as a swing trade and a different principle when placing an intraday trade. Nevertheless, these are time-tested principles that work if applied correctly to the right kind of trade.

1. Place your stop-loss at a point where your trade idea will be invalidated

This is the main principle that you should always consider when deciding where to place your stop. In simple terms, it means that if you are in a long trade, you should strive to place your stop-loss at a point where if the price reaches it, then a long trade would not be viable. Basically, your stop-loss should be placed at a location where if the price reaches it, then the long trade setup has been invalidated, which paves room for short trade setups.

The same is true for short trades where you should place your stop-loss orders at a point which if reached means that the price trend has changed at that the setup no longer favors a short trade but a long trade.

Given that this is the first and most important principle when it comes to placing a stop-loss order, you should always consider it first before moving on to other principles and factors.

2. The risk to reward ratio

This is the second most important principle when it comes to choosing the location of your stop-loss. Many traders prefer to enter into trades with a 1:2 risk-reward ratio, which means that for every dollar (pip) that they risk, they have the chance to make two dollars (2 pips) if the trade goes their way. This is not the only risk-reward ratio that you can use as some trade setups may allow you to go for a 1:5 risk-reward ratio or a smaller 1:1.5 R/R ratio depending on where you enter into a trade and your potential target.

Following this principle, you have to place your stop-loss at a position that will allow you to reach your potential target depending on the trade setup.

For example, if you are trading a breakout that has a potential to bag 100 pips given that this is the distance to the next support level, you could choose to risk 50 pips on the trade for a chance at bagging 100 pips profit for a substantial 1:2 risk/reward ratio.

The same reasoning applies to trades where you target lesser pips, which could affect the position of your stop-loss, in order to maintain your preferred risk-reward ratio.

A word of caution

Many traders become fixated on their risk-reward ratios to the point of completely ignoring the first principle of setting your stop-loss at a point where your trade idea will be invalidated if the price hits that level.

You should always try to avoid setting your stop-loss at a short distance in order to increase your risk-reward ratio at the expense of giving your trade enough room to actually go in your favor.

This why it is important to always factor in the percentage of your trading account that you are willing to risk on each trade and then lower or increase the number of lots you trade in order to always stay within your risk limits.

The four types of stop-loss orders

There are four types of stops as listed below:

- Percentage stop

- Volatility stop

- Chart stop

- Time stop

The percentage stop

Many traders are advised to risk a maximum of 2% on each trade in order to protect their trading capital. This means that the trader never exceeds the 2% mark when placing the stop-loss regardless of market conditions, which is a good way to protect your trading.

However, there is a huge disadvantage to this method of setting your stop-loss as it does not account for the market conditions and the trade setup that you are in. Remember the cardinal rule of setting a stop-loss is to place your stop-loss order at a point where your trade idea will be invalidated.

For example, Tom has a $200 account with a broker and wants to enter into a trade on the EUR/USD currency pair. This is a long-term trade as he is a swing trader who only goes for trade setups that offer a minimum of 1:2 risk-reward ratio.

The current setup has the potential to net 100 pips for Tom, but he will have to risk 50 pips according to his trading plan, which he is comfortable with given that his trade setup would be invalidated if the trade moves against him by 46 pips as there is a strong support level at 45 pips.

Risking 2% of his account on the trade means that he would have a maximum risk of $4, which means that even when trading 0.01 lots, he would have to risk $5 (2.5%) in order to place his stop-loss order 50 pips away from his entry.

In this case, Tom would be better served risking the $5 and giving his trade room to move in his favor instead of a 40 pip stop-loss (risking $4) that could lead to him being stopped out then watching from the sidelines as the trade moves in his chosen direction, while he makes a loss.

The volatility stop

Setting your stop-loss based on volatility is a prudent method given that it is based on a currency pair’s price movements in the past, which can be a good indicator of future performance.

There are a number of ways you can track volatility in order to place your stop-loss order at a safe distance with the most popular ones involving the use of Bollinger bands and the average true range (ATR) indicator.

Using Bollinger bands

Setting your stop-loss using Bollinger bands is quite simple and effective when your trade setups involve a trading range where the price is mostly stuck within the Bollinger bands. This means that you are taking short trades when the price hits the upper band and taking short trades when the price hits the lower band.

In this scenario, you simply set your stop-loss order a small distance from the point at which you took your trade whether it is a long or short trade. This method allows you to place your stop-loss order based on the trade setup instead of a fixed percentage.

Using the ATR indicator

Another common way to set your stop-loss based on price volatility is to use the average true range (ATR) indicator to determine the right stop-loss distance for your trade. Given that the ATR measures the average distance that a currency pair moves in a particular time period, it is a good idea to use it when determining your stop-loss distance.

You can use the ATR indicator on any chart with time frames ranging from as low as 5 minutes to as high as the daily and weekly charts for swing and position traders. The key to using the ATR indicator to calculate your stop-loss distance is to determine the mean ATR value over your chosen period and then place your stop-loss order in accordance with the ATR value.

For example, a swing trader with a potential trade entry on GDP/USD daily chart would add the ATR indicator to the chart and note the ATR value at his trade entry position and use it as his/her stop-loss order.

A position or trend trader with the same trade setup may choose to multiply the ATR value by 3 and use the result as his/her stop-loss order. You should always pay attention to a currency pair’s price volatility when setting your stop-loss order, which is why this method works well.

The chart stop or how to use support and resistance levels to set your stop-loss orders

One of the best ways to set your stop-loss order is to use established support and resistance levels as strategic stop-loss levels given that if price breaks above a resistance or support level, then your trade idea will have been invalidated.

Using previous support and resistance levels is a brilliant way to ensure that you exit a trade quickly once it is invalidated. However, you should not place your stop-loss orders very close to your chosen support level as in many cases the price may spike below the support level before reversing and moving in your chosen direction.

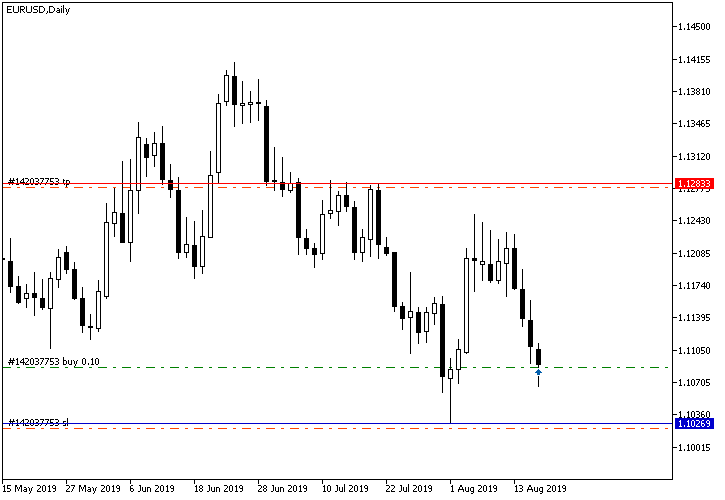

The chart below shows an example of such stop-loss and take-profit levels set just below the support and resistance lines respectively.

Support and resistance levels also offer excellent trade entry setups, especially when they are respected as you can simply place your stop-loss order slightly below the resistance level. Furthermore, you can use the same principle to set stop-loss orders for breakout trades that arise when the existing support and resistance levels are broken.

A time-based stop-loss order

Placing a stop-loss order based on specific time limits is a good method to get you out of trades that are not going anywhere, yet they are keeping your trading capital locked. Some traders also prefer to be out of the markets at specific times such as over the weekend, which means that they typically close their trades on Friday evening.

Some intraday traders have a rule of not holding trades overnight as this gives the trade time to go against them, in which case they typically set their trades to expire by end of the day. Other traders may use stop-loss orders based on times when they can actively trade the markets, ensuring they have no running trades when they are not active in the markets.

This method is popular among short-term traders who avoid holding trades overnight, as well as swing traders who may exit their positions as the weekend approaches, just as they may avoid entering into new trades on Friday afternoon or early Monday morning.

Avoid these common mistakes when placing your stop-loss orders

1. Very tight stops

Avoid using very tight stop-loss orders unless the trade setup warrants such a move. For example, if you have a profit target of 100 pips on the EUR/USD currency pair in a volatile market, you are better served using a wider stop-loss to accommodate the price volatility.

2. Using a set number of pips as standard

Many traders commit this mistake by sticking to a set number of pips risk for every trade, yet there are no two trade setups that are exactly the same. Always be flexible when it comes to the number of pips you risk with the main goal beings to place your stop-loss at a distance where your trade idea will be invalidated if the stop-loss order was triggered.

3. Very wide stops

The opposite of very tight stop-loss orders is very wide stop-loss orders, which either increase your chances of making huge losses by being overly exposed to the markets or cause you to trade very small positions. Follow the above guidelines to ensure that you place your stop-loss orders at the right distance, neither too wide nor too short.

4. Support and resistance levels

Never place your stop-loss orders exactly on a resistance or support line as price tends to whipsaw around such areas as the bulls and the bears fight for control. Always leave a safe distance between a support or resistance level and your stop-loss order. You can do this by treating these levels as a zone instead of a single line.

If you want to get news of the most recent updates to our guides or anything else related to Forex trading, you can subscribe to our monthly newsletter.