Hello all, new to the forum, look forward to interacting with everyone.

The goal of this thread is to show traders a more consistent, reliable way of trading the Currency Market using Price Action on the Daily & 4 Hour Charts. You will see a more practical, realistic way of trading that is in sync with the major market movements, independent of;

Statistical Indicators are the most widely used tools in trading, but most are based on past price data. This makes them lagging in nature and inaccurate when providing entry signals. Short-term economic data are also used to support technical-based trading, but most are often quite volatile and lead to erratic, short-lived reactions. Since the major economic factors that actually lead to strong currency movements will be reflected on the Larger Time Frames, waiting on these signals for market direction will always be the better decision for traders.

The reality of Forex Trading is the vast majority of persons lose money. Since most tend to be Day Traders, using the smaller time frames for their trading, the high failure rate is at least highly correlated with this way of trading, if not the cause of it.

Most persons that were exposed to the market for the first time are likely to have headed straight for the smaller time frames in an attempt to capture small, but quick pips. This is what the Trading, Marketing and Brokerage Companies promote since the more frequently their clients trade, the more money there is for them, regardless of how profitable Day Trading actually is. If we were in charge of these companies, wouldn't we do the same?

This isn't to say that there aren't successful Day traders, but there are several bad habits that are forced upon them by the volatile nature of the Smaller Time frames and daily currency movements that makes it highly unlikely:

Another reason relates to the promoted approach to Currency Trading that comes from the prevalent culture in today’s society;

Everything must be done NOW OR ELSE SOMEONE HAS TO PAY! Am I right?

Trading is just a click away and with the ability to see several pips of movement happening right in front of us everyday, it is very tempting to want to trade when we want to. But desire is one thing and reality is another.

Feeding our emotions on a regular basis when it comes to money is a recipe for disaster; using Discipline, Patience and Self-control along with High Probability, Stable Trades are the pillars for financial success over the LONG-TERM.

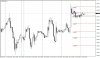

This is what the Swing Trading on the Larger Time Frames offer. You can identify a setup, trade it, then leave it until the target is hit a few days later. No need to micro manage your trade. Just by taking a cursory glance at these time frames relative to the smaller charts you can see the stability and consistency in their movements. When this is combined with Price Action, which identifies high probability candlestick patterns, trading becomes a lot simpler.

I used to Day Trade and failed at miserably, no matter how often I tried different approaches. It was only after several years of losing money that I actually began looking at the higher time frames and started to be profitable.

With the help of my Trading Manual that details all the rules needed to properly trade on the higher time frames, I will provide the results of upcoming trades that will be based on;

Follow my Swing Trades in this thread and appreciate a consistent way of trading that provides higher returns for Long-Run wealth creation.

Regards,

DRFXTrading

----------------------------------------------------------------

The goal of this thread is to show traders a more consistent, reliable way of trading the Currency Market using Price Action on the Daily & 4 Hour Charts. You will see a more practical, realistic way of trading that is in sync with the major market movements, independent of;

- Lagging Statistical Indicators;

- Contradictory Economic News;

- Volatile, Stressful Lower Time Frames;

Statistical Indicators are the most widely used tools in trading, but most are based on past price data. This makes them lagging in nature and inaccurate when providing entry signals. Short-term economic data are also used to support technical-based trading, but most are often quite volatile and lead to erratic, short-lived reactions. Since the major economic factors that actually lead to strong currency movements will be reflected on the Larger Time Frames, waiting on these signals for market direction will always be the better decision for traders.

The reality of Forex Trading is the vast majority of persons lose money. Since most tend to be Day Traders, using the smaller time frames for their trading, the high failure rate is at least highly correlated with this way of trading, if not the cause of it.

Most persons that were exposed to the market for the first time are likely to have headed straight for the smaller time frames in an attempt to capture small, but quick pips. This is what the Trading, Marketing and Brokerage Companies promote since the more frequently their clients trade, the more money there is for them, regardless of how profitable Day Trading actually is. If we were in charge of these companies, wouldn't we do the same?

This isn't to say that there aren't successful Day traders, but there are several bad habits that are forced upon them by the volatile nature of the Smaller Time frames and daily currency movements that makes it highly unlikely:

- Indecision about the size of stop losses and pip targets;

- Constantly switching from currency to currency to decide on which to trade in the very short trading day;

- Anxiously waiting on a target to be hit;

- Indecision as to whether to monitor a trade or leave it until it is closed;

- The pressure to meet daily or weekly pip targets/monetary goals;

- Resisting or falling to the temptation of violating a trade plan in order to meet these targets;

- Trying to stay objective while wanting to take ´revenge´ on the market for a loss ;

- Getting more emotional, irritable and anxious than you normally are;

- Feeling trapped like a mouse in a maze, with the cheese nowhere to be found;

Another reason relates to the promoted approach to Currency Trading that comes from the prevalent culture in today’s society;

Everything must be done NOW OR ELSE SOMEONE HAS TO PAY! Am I right?

Trading is just a click away and with the ability to see several pips of movement happening right in front of us everyday, it is very tempting to want to trade when we want to. But desire is one thing and reality is another.

Feeding our emotions on a regular basis when it comes to money is a recipe for disaster; using Discipline, Patience and Self-control along with High Probability, Stable Trades are the pillars for financial success over the LONG-TERM.

This is what the Swing Trading on the Larger Time Frames offer. You can identify a setup, trade it, then leave it until the target is hit a few days later. No need to micro manage your trade. Just by taking a cursory glance at these time frames relative to the smaller charts you can see the stability and consistency in their movements. When this is combined with Price Action, which identifies high probability candlestick patterns, trading becomes a lot simpler.

I used to Day Trade and failed at miserably, no matter how often I tried different approaches. It was only after several years of losing money that I actually began looking at the higher time frames and started to be profitable.

With the help of my Trading Manual that details all the rules needed to properly trade on the higher time frames, I will provide the results of upcoming trades that will be based on;

- High Probability Trade Setups that Require Less Trading;

- Predictable times for entry using the Daily and 4 Hour Charts;

- Clear Candlestick Patterns that start and end Trends;

- 100- 200 Pip Trades such as those executed during the Financial Crisis and European Debt Crisis and that have already beaten the BarclayHedge Top 10 Traders this year;

- Practical, Unemotional ways to avoid checking trades;

- Pre-determined exit rules based on each trade setup;

- Weekly & Monthly Ranges not seen in any other strategy;

- New insights that surpass the popular but recycled information;

- A Proven set of parameters built on 10 years of trading and analysis of market patterns;

Follow my Swing Trades in this thread and appreciate a consistent way of trading that provides higher returns for Long-Run wealth creation.

Regards,

DRFXTrading

----------------------------------------------------------------